LOOKING FOR A MONEY RESET? GET YOUR $ QUESTIONS ANSWERED!

Connect with Shavon, March 17th-22nd on Piñata Instagram

Build Your Credit Credibility!

Finance IQ empowers renters like you, by showing how credit building leads to lasting financial stability. And this is just the beginning… Learn the credit basics and see how a higher score unlocks new opportunities.

Unlock Credit-Building insights, plus real feedback from renters like you.

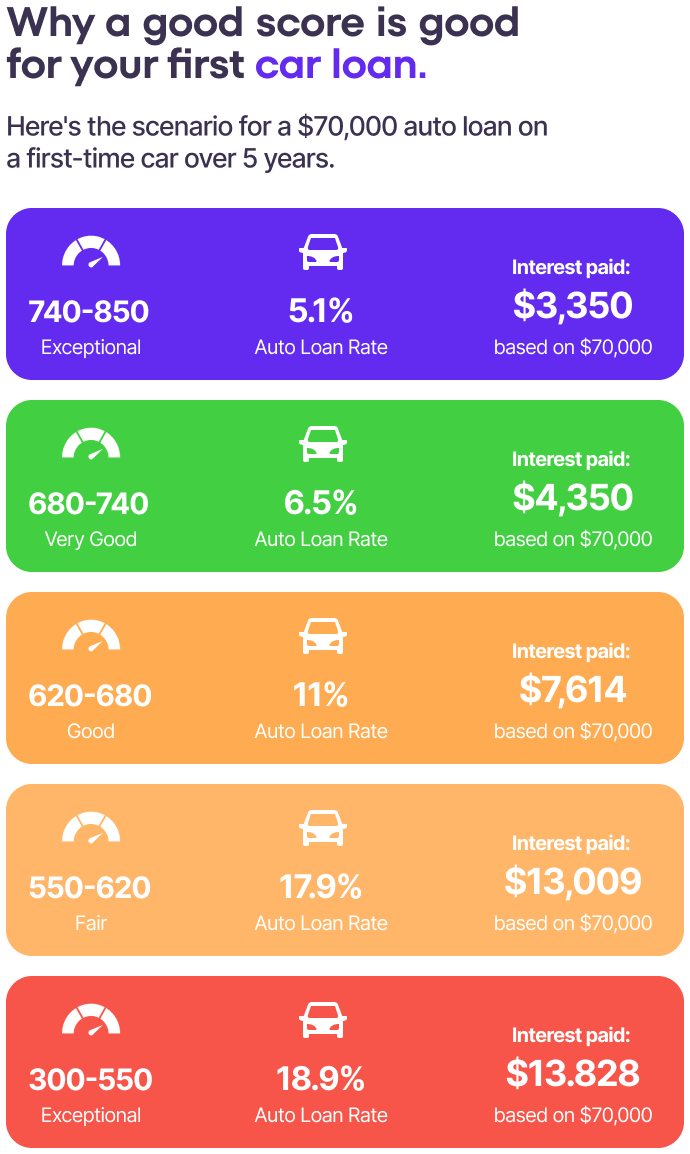

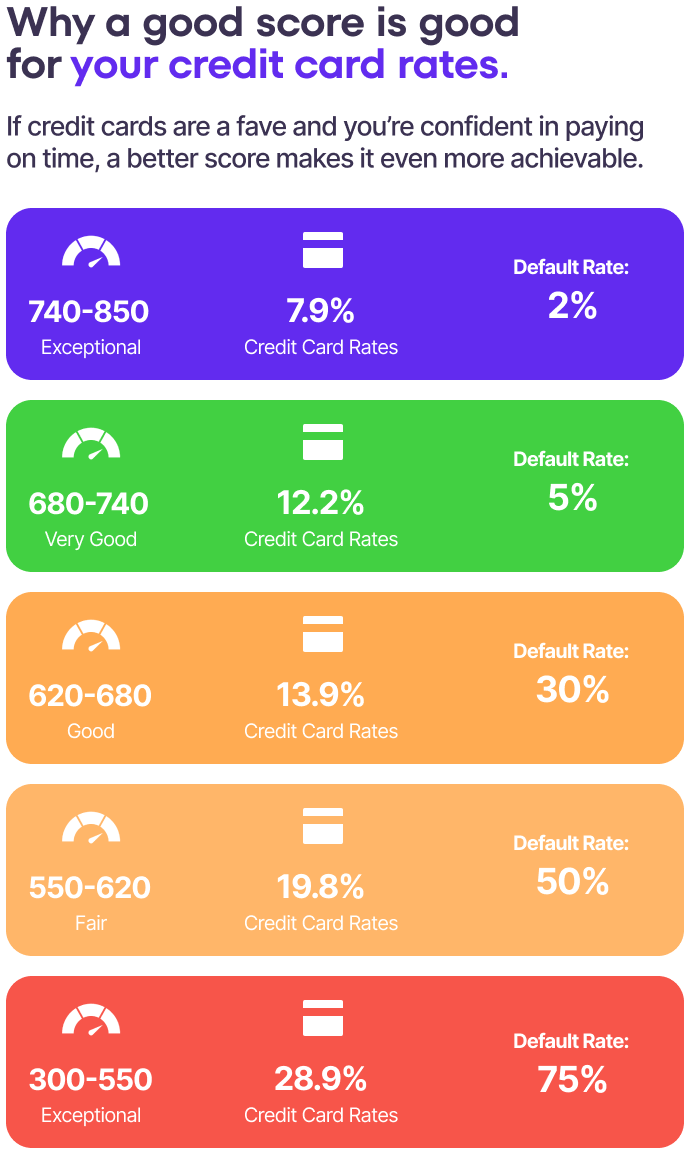

How a better score can

move the needle in your life.

What happens when I start Credit Building with Piñata?

How does it work with Piñata?

What if I never had a credit score?

What if I have a very low credit score?

What if I have other outstanding loans and credit card debt?

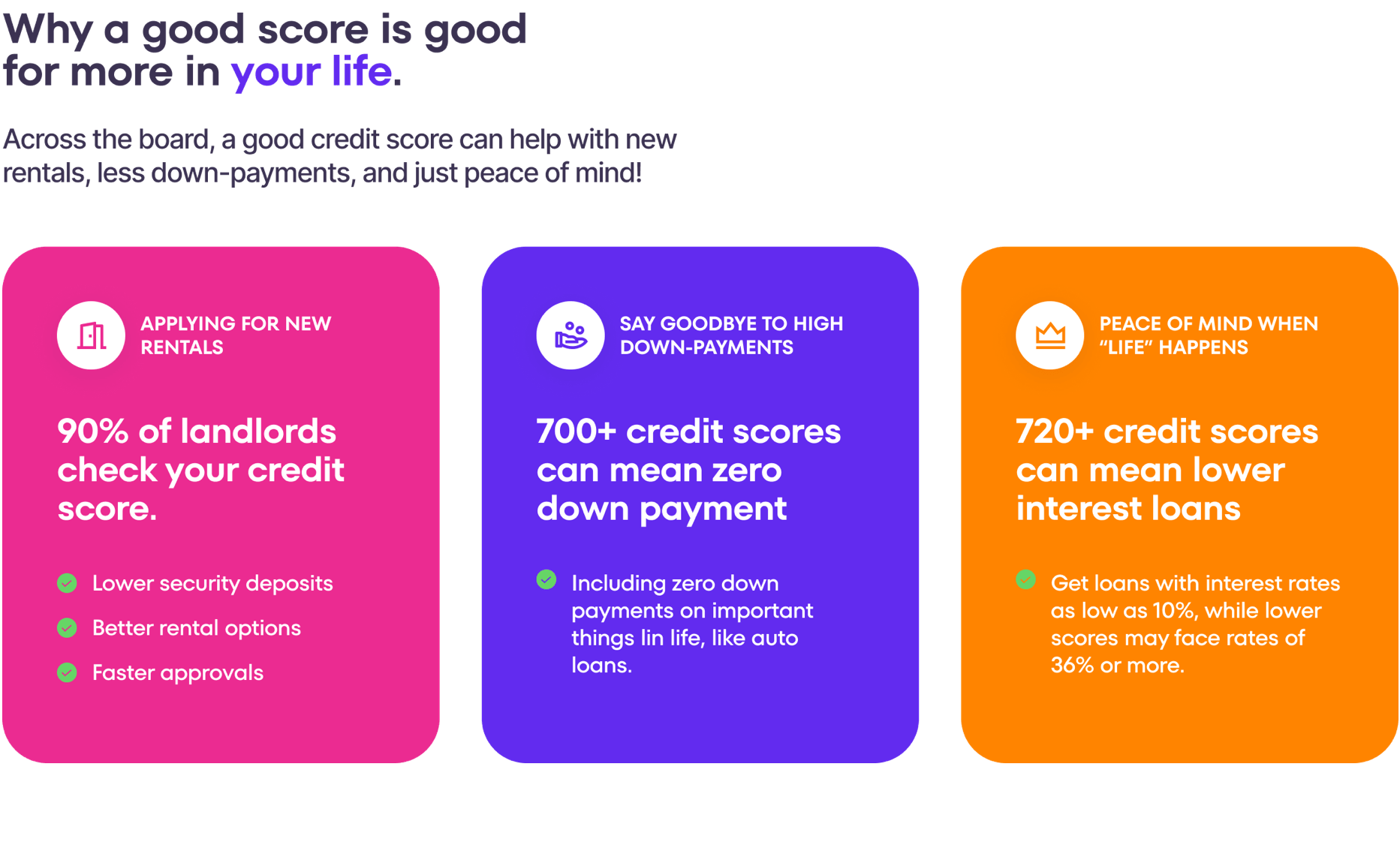

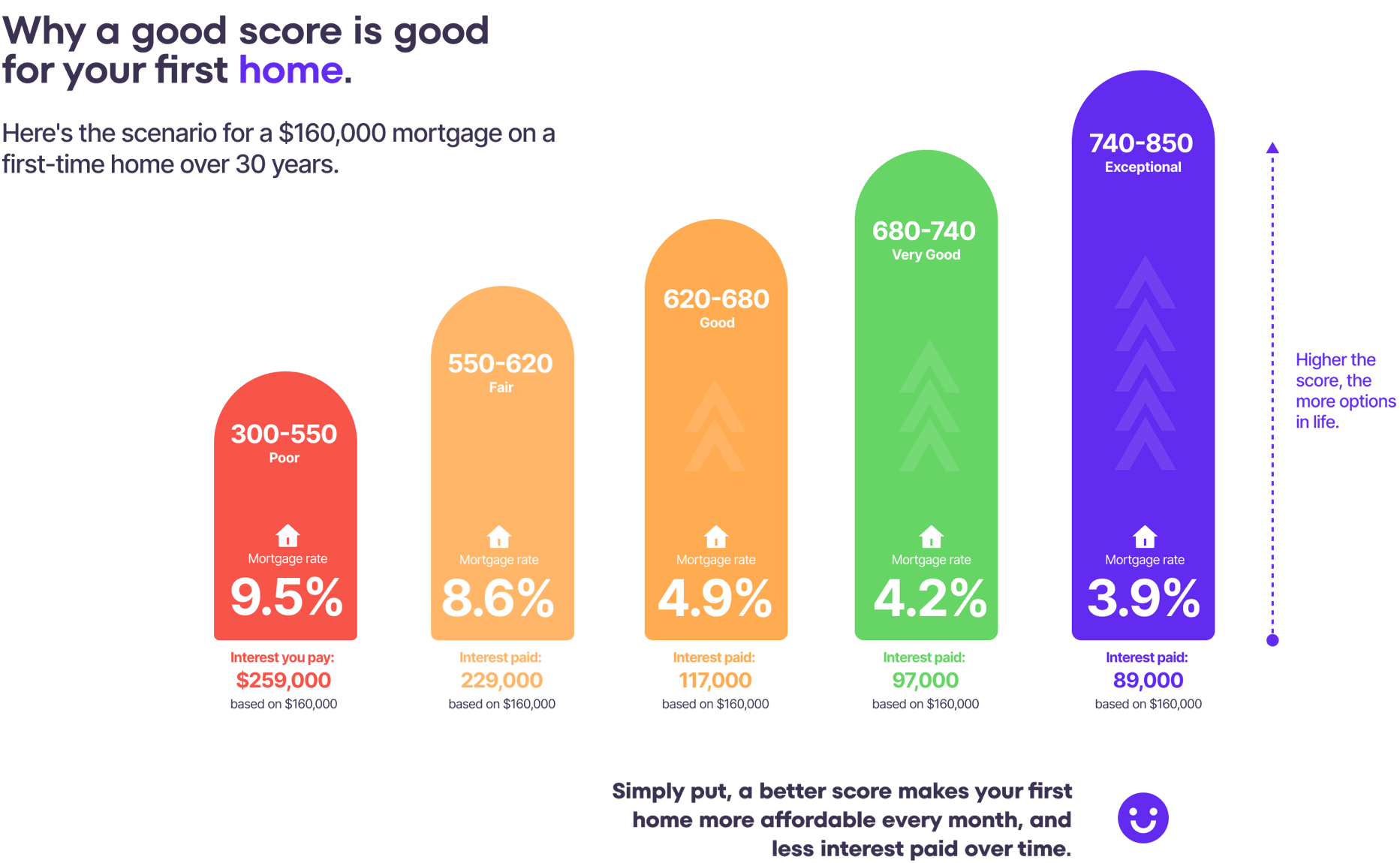

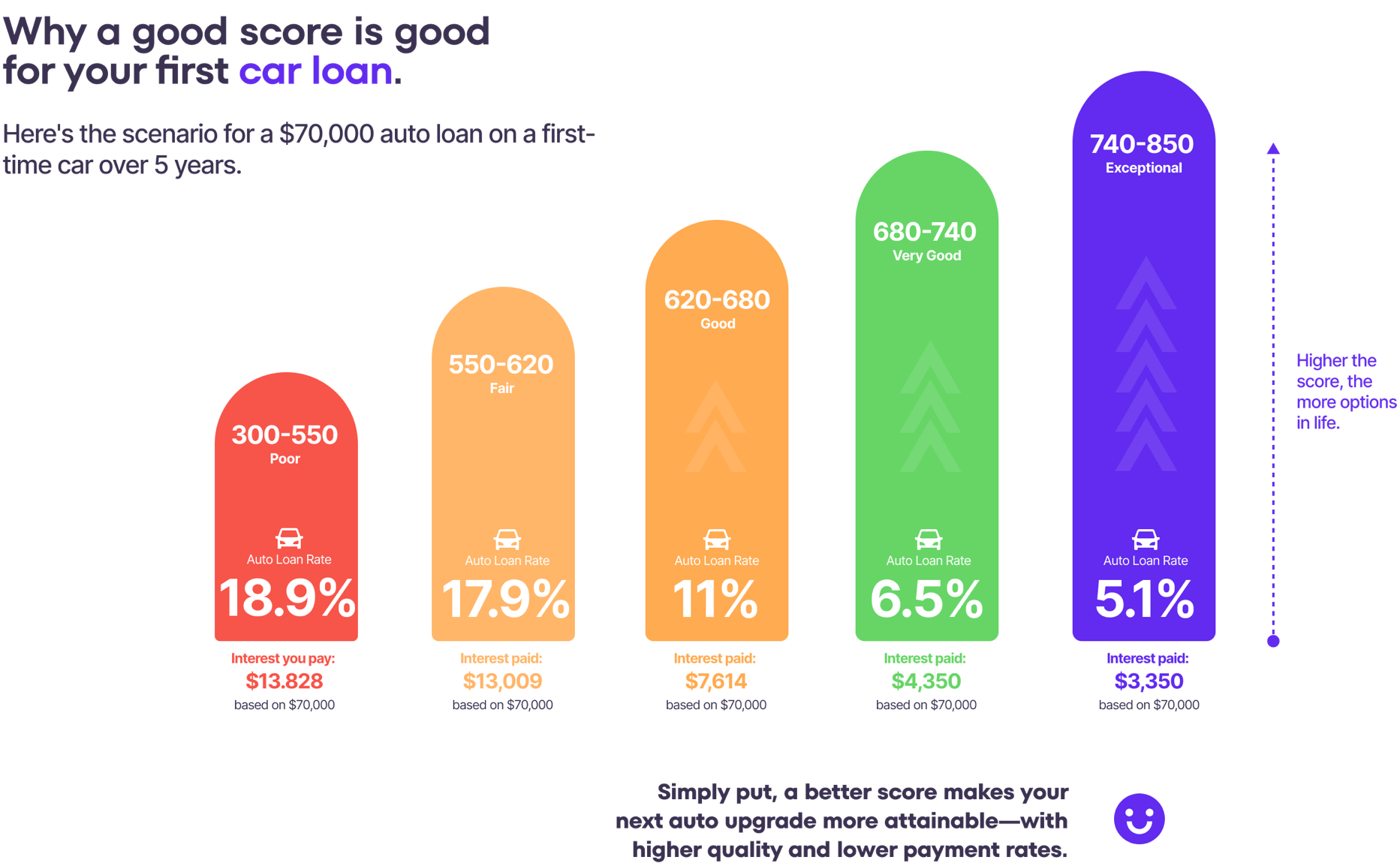

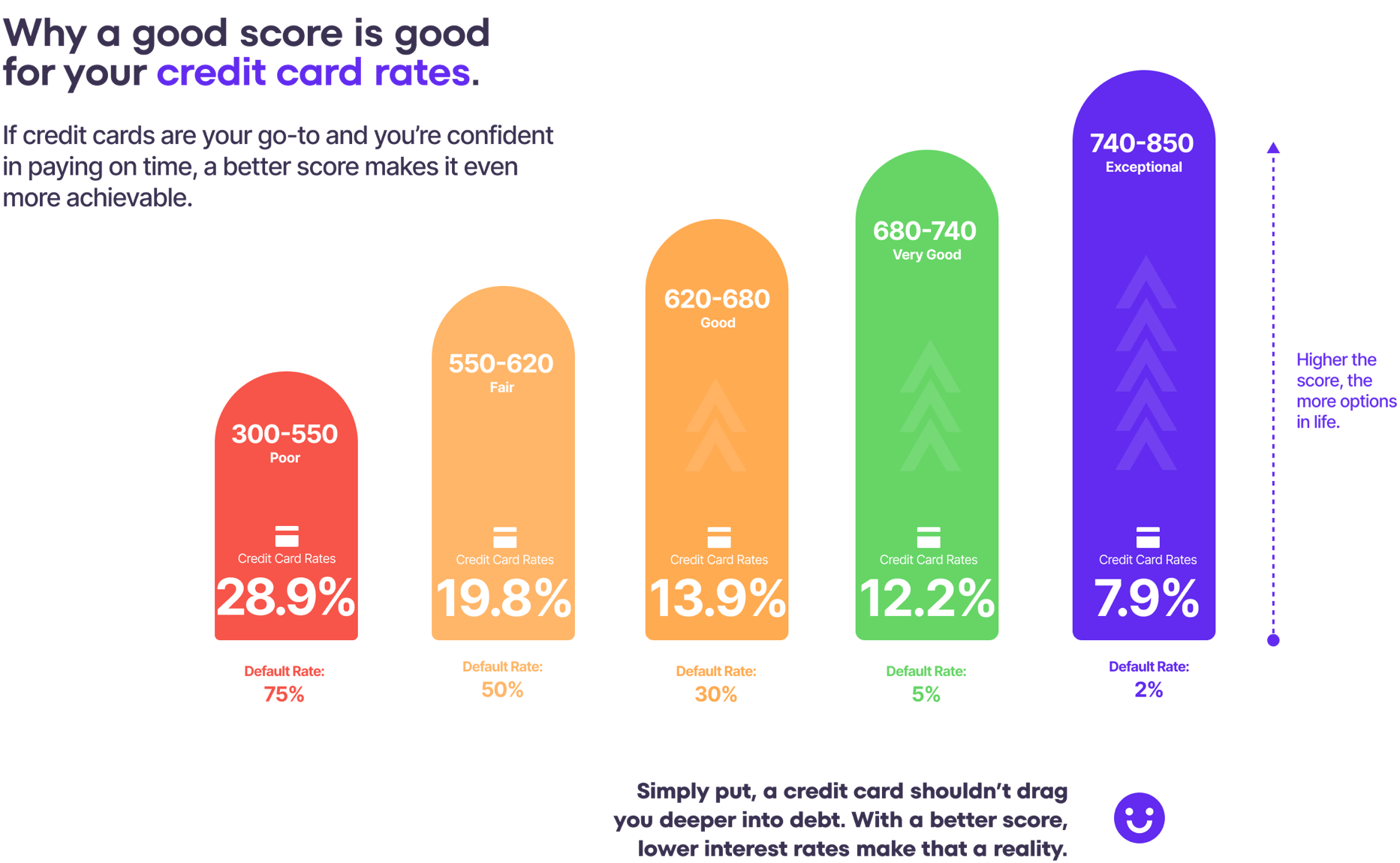

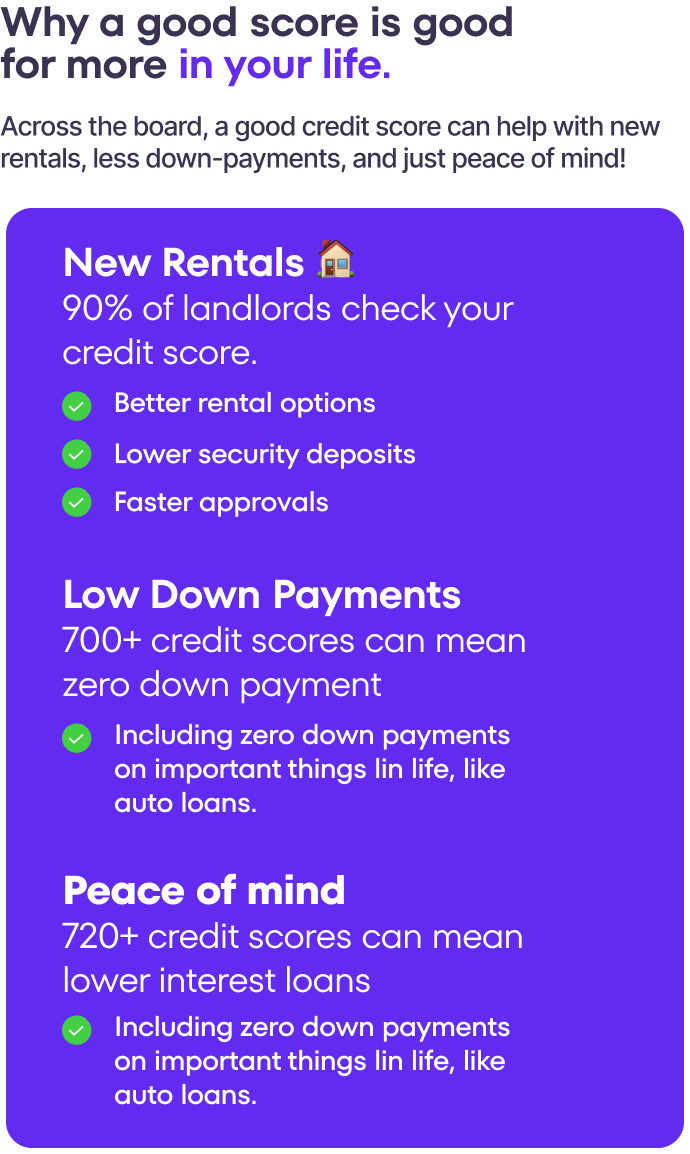

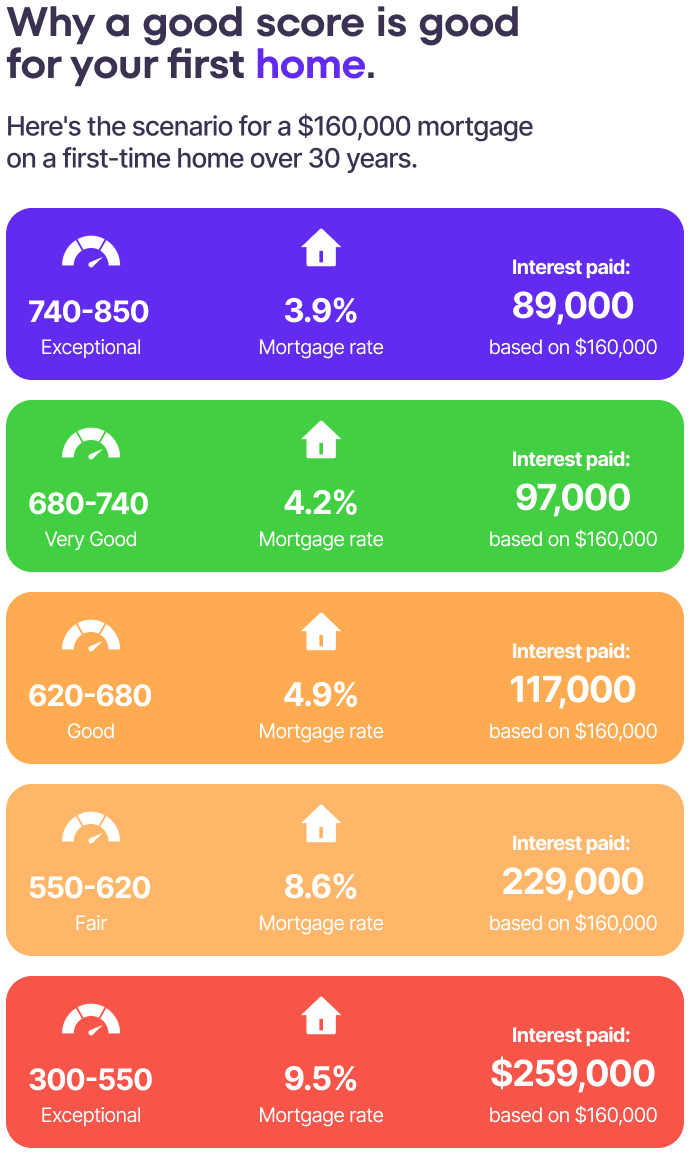

What are the real benefits of a better credit score?

What is a good credit score?

What factors affect my credit score?

The main factors that influence your credit score are:

– Payment history (35% of FICO Score)

– Credit utilization (30%)

– Length of credit history (15%)

– Credit mix (10%)

– New credit inquiries (10%)

How often does my credit score change?

How can I improve my credit score?

– Make all payments on time:

This is crucial as your payment history is a significant factor in your credit score.

– Keep credit card balances low:

Aim to use less than 30% of your available credit.

– Avoid applying for new credit too often:

Each application can lead to a hard inquiry, which might lower your score.

– Maintain a mix of credit types:

Having a variety of credit accounts, such as credit cards and loans, can be beneficial.

– Keep old accounts open:

This helps maintain the length of your credit history, which positively impacts your score.

– Dispute any errors on your credit reports:

Regularly check your credit reports for inaccuracies and dispute them if necessary.

Sign up to Piñata:

Piñata reports your on-time rent payments to all three major credit bureaus, which can have a substantial positive impact on your credit score. Piñata also offers free back reporting, which means Piñata can report past on-time rent payments, further boosting your credit score.

Renters are boosting their credit scores simply by reporting their rent.

Meet: Shakai

Score Jump: 100+

Meet: Ashleigh

Score Jump: 125+

Meet: Tamar

Score Jump: 75+

Meet: Haley

Score Jump: 40+

Meet: Shardanay

Score Jump: 40+

About Piñata

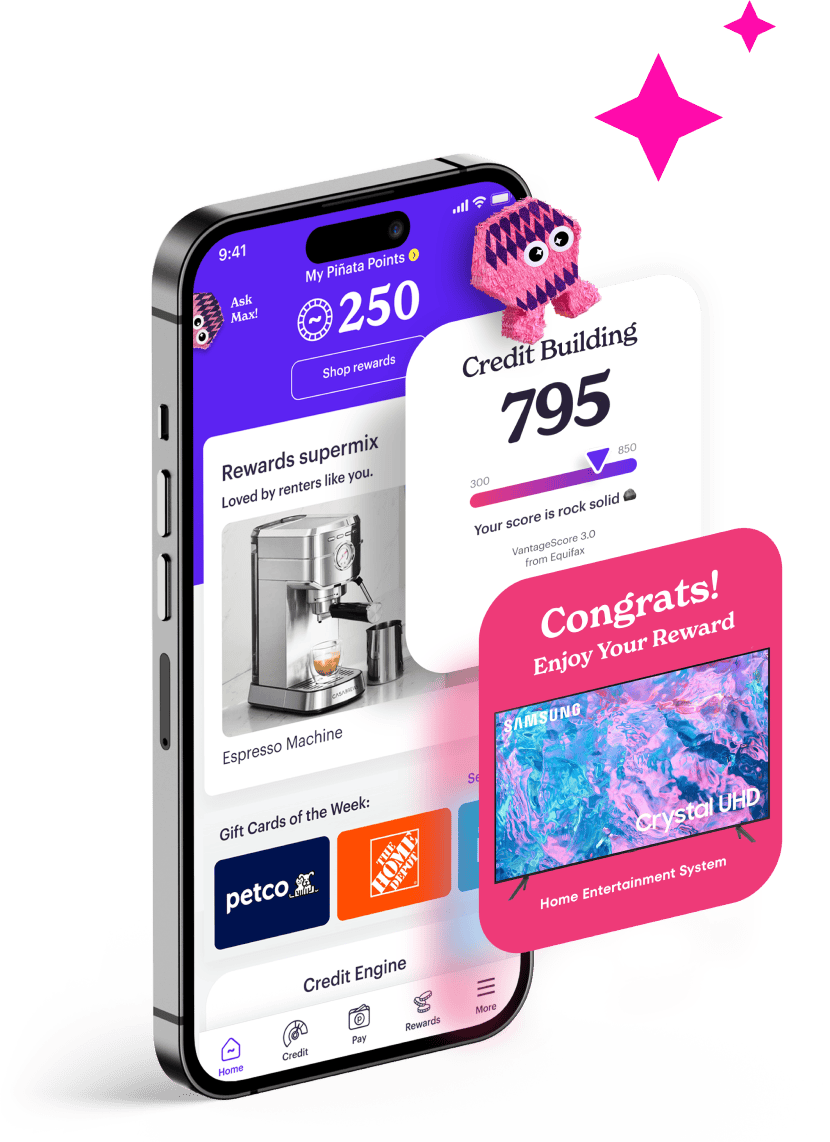

Piñata is a rewards and credit-building program for renters. By reporting on-time rent payments to major credit bureaus, Piñata helps renters improve their credit scores, offering a path to greater financial health. Beyond credit-building, users earn Piñata Points for paying rent, which can be redeemed for a variety of rewards, from everyday essentials to exclusive giveaways. It’s a simple way to turn routine payments into tangible benefits while working toward financial empowerment.

About Shavon Roman

Shavon Roman is a top financial advisor in Atlanta, known for her expertise in optimizing financial resources and future planning. Twice recognized by the National Association of Insurance and Financial Advisors (NAIFA) as one of Atlanta’s top young professionals, Shavon holds Series 6, 63, and 65 FINRA licenses.

Her philosophy, “Heal. Plan. Invest.,” reflects her holistic approach—helping clients heal from past financial challenges, plan strategically, and invest wisely. As the host of Piñata’s Finance IQ, Shavon offers expert guidance to empower renters and homeowners to achieve financial wellness.